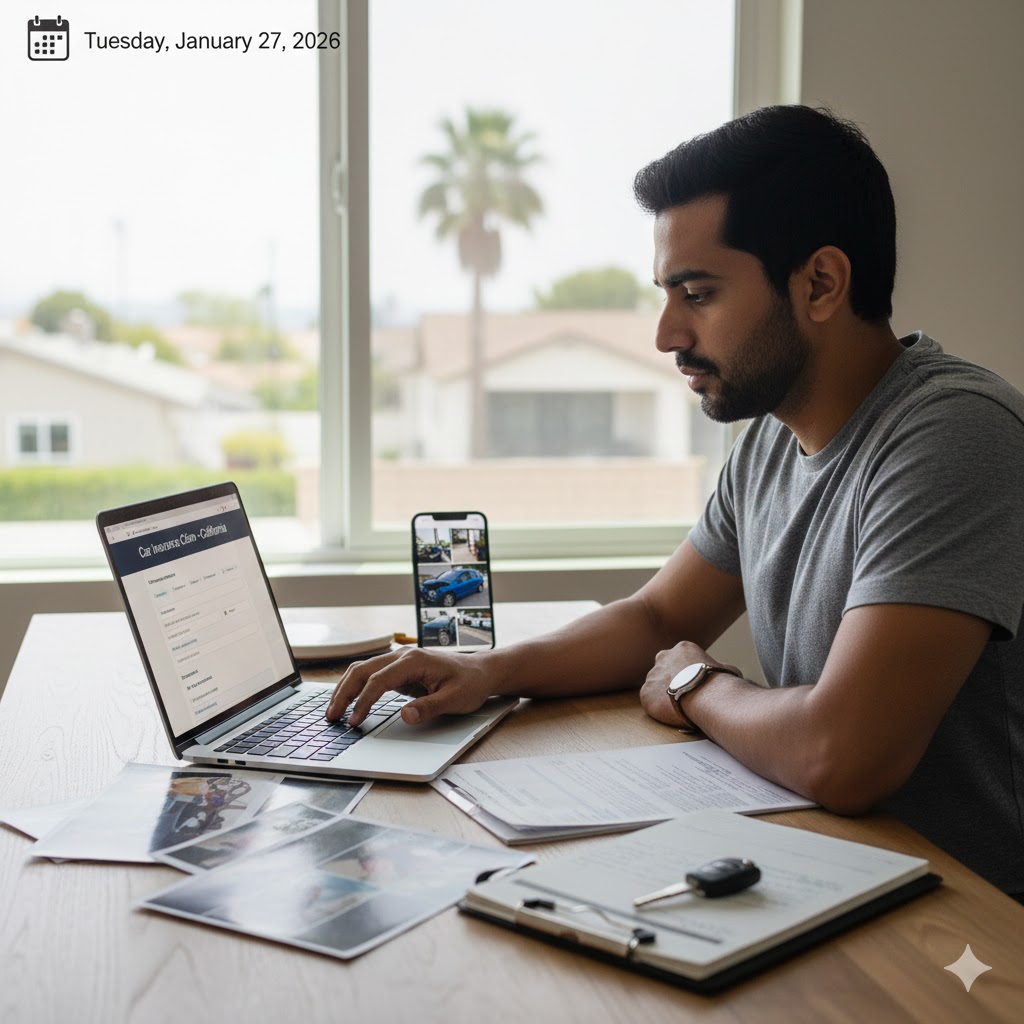

Filing a car insurance claim in California step by step

Filing a car insurance claim in California is a structured process governed by state law, insurance regulations, and policy-specific requirements. While insurers often present claims as simple, the reality is that each step carries legal and financial consequences. How a claim is reported, documented, investigated, and negotiated can significantly affect both the speed of resolution and the final settlement amount.

Many drivers make mistakes during the claim filing process without realizing it. Missing documentation, poorly timed statements, or misunderstanding coverage options can lead to delays, reduced payouts, or denied claims. California’s consumer protection laws provide safeguards, but those protections work best when drivers understand how the system operates.

This guide explains how to file a car insurance claim in California step by step, from the moment you decide to file through investigation, settlement, and claim closure. It is written as a practical, state-specific authority resource and as a core satellite supporting a complete California auto insurance claim guide silo.

Step 1: Decide which type of claim to file

Before contacting an insurer, you must identify the correct claim path.

In California, claims generally fall into one or more of the following categories:

- Liability claims against the at-fault driver’s insurer

- Collision claims with your own insurer

- Comprehensive claims with your own insurer

- Uninsured or underinsured motorist claims

Each claim type follows different rules, timelines, and strategic considerations.

Step 2: Review your insurance policy

Understanding your policy before filing a claim is critical.

You should review:

- Coverage types and limits

- Deductibles

- Exclusions

- Notification requirements

- Cooperation clauses

Policies often require prompt notice and cooperation. Failing to comply can jeopardize coverage.

Step 3: Notify the appropriate insurance company

Once you determine the claim type, notify the appropriate insurer.

Notifying your own insurer

You should notify your insurer if:

- You plan to file a collision or comprehensive claim

- You have uninsured or underinsured motorist coverage

- There is a possibility you may need coverage later

Notification protects your rights even if you do not immediately pursue payment.

Notifying the other driver’s insurer

If the other driver is at fault, you may file a liability claim directly with their insurer. This approach may avoid deductibles but can involve longer investigations and more negotiation.

Step 4: Provide the first notice of loss

The first notice of loss is the formal opening of a claim.

Insurers typically ask for:

- Date, time, and location of the accident

- Description of what happened

- Names of involved parties

- Vehicle information

- Police report details if available

Provide factual information only. Avoid speculation or admissions of fault.

Step 5: Obtain a claim number and adjuster assignment

After the claim is opened:

- A claim number is issued

- An adjuster is assigned

- Communication channels are established

Record the claim number and adjuster contact information immediately. All future communication should reference the claim number.

Step 6: Submit supporting documentation

Documentation is the backbone of a successful claim.

Commonly required documents include:

- Photos and videos of the accident scene

- Police reports

- Repair estimates

- Medical records and bills

- Proof of lost wages

- Rental car receipts

Timely submission helps prevent delays and disputes.

Step 7: Vehicle inspection and damage assessment

For property damage claims, insurers must assess vehicle damage.

Inspection methods

Inspections may be conducted:

- In person by an adjuster

- At a repair facility

- Through photo-based estimating systems

California law allows drivers to choose their repair shop, although insurers may recommend preferred providers.

Step 8: Repair estimates and approval

Once damage is assessed:

- An estimate is prepared

- Repairs are authorized

- Payment arrangements are discussed

Drivers should review estimates carefully. Discrepancies between estimates and actual damage are common and may require supplemental claims.

Step 9: Handling deductibles

If you file a claim with your own insurer:

- You are responsible for the deductible

- The deductible may be reimbursed later through subrogation if the other driver is at fault

Deductible recovery can take time and is not guaranteed.

Step 10: Medical claims and injury documentation

In injury claims, documentation must clearly link injuries to the accident.

Insurers evaluate:

- Timing of treatment

- Consistency of medical records

- Severity and duration of injuries

- Compliance with treatment plans

Incomplete or delayed medical documentation often reduces settlement value.

Step 11: Ongoing communication with the adjuster

California insurers are required to communicate reasonably and promptly.

Best practices include:

- Keeping communication in writing when possible

- Responding to reasonable requests

- Keeping copies of all correspondence

- Avoiding unnecessary recorded statements

Adjusters are trained negotiators. Prepared communication protects your position.

Step 12: Fault evaluation and comparative negligence

During the investigation, insurers assess fault.

California’s pure comparative negligence system allows fault to be shared. Settlement offers are reduced by your assigned percentage of fault.

Disputes over fault are common and often resolved through negotiation.

Step 13: Settlement evaluation and negotiation

Once liability and damages are established, settlement discussions begin.

Settlement may include:

- Vehicle repair or replacement payment

- Medical expense reimbursement

- Lost wage compensation

- Pain and suffering damages

Drivers are not required to accept the first offer. Negotiation is expected.

Step 14: Total loss determinations

If repair costs exceed a certain threshold, the vehicle may be declared a total loss.

California requires insurers to:

- Use fair market value

- Disclose valuation methods

- Explain settlement calculations

Drivers may dispute valuations with supporting evidence.

Step 15: Reviewing and accepting a settlement

Before accepting any settlement:

- Review the offer carefully

- Confirm all damages are included

- Understand whether the settlement is final

Settlement agreements often include release language that permanently closes the claim.

Step 16: Claim denial or partial denial

Claims may be denied or partially denied for reasons such as:

- Coverage exclusions

- Disputed liability

- Insufficient evidence

- Policy violations

Denials must be explained in writing. Denied claims may be appealed or escalated.

Step 17: Escalating a claim when problems arise

If issues occur, drivers may:

- Request a supervisor review

- Submit additional documentation

- File a complaint with the California Department of Insurance

- Seek legal advice

California law provides remedies for improper claim handling.

Step 18: Claim closure and recordkeeping

Once a claim is resolved:

- Retain all records

- Confirm payments have cleared

- Verify repairs were completed properly

Claims may affect future premiums, so documentation is important.

Common Mistakes during the claim filing process

Frequent mistakes include:

- Failing to notify insurers promptly

- Providing inconsistent statements

- Missing deadlines

- Accepting low settlement offers too quickly

- Failing to document damages fully

Avoiding these errors improves outcomes.

How the Step-by-Step process protects you

A structured approach ensures:

- Compliance with policy requirements

- Preservation of evidence

- Strong negotiation position

- Reduced risk of denial

California’s claim system rewards preparation and documentation.

Filing a car insurance claim in California is not a single action but a multi-stage process that unfolds over time. Each step, from first notice to final settlement, influences the outcome. Drivers who understand the process, document thoroughly, and communicate strategically are far more likely to achieve fair and timely resolutions.

This step-by-step guide provides the framework for navigating California auto insurance claims effectively. The next satellite will focus on claim timelines, delays, and how long auto insurance claims typically take in California.