How to switch auto insurance in California without a coverage lapse

One of the biggest fears drivers have when switching auto insurance providers is accidentally creating a coverage lapse. In California, this fear is justified. Even a short lapse in auto insurance coverage can trigger serious consequences, including vehicle registration suspension, fines, higher future premiums, and difficulty obtaining affordable coverage.

Fortunately, California law also provides clear rules and safeguards that make it possible to switch auto insurance providers safely and seamlessly, as long as the process is handled correctly. Most coverage lapses occur not because switching is risky, but because drivers cancel policies in the wrong order or misunderstand how coverage reporting works.

This article explains how to switch auto insurance in California without a coverage lapse, step by step. It covers legal requirements, timing rules, DMV reporting, cancellation procedures, common mistakes, and best practices. It is written for drivers who want to switch insurers confidently and for automotive insurance niche websites seeking high-trust, evergreen content.

Why coverage lapses are a serious issue in California

California requires continuous auto insurance coverage for all registered vehicles.

Legal requirements

California law mandates that:

- Every registered vehicle must maintain active liability insurance

- Insurers report coverage electronically to the DMV

- Gaps in coverage can trigger automatic penalties

Because reporting is electronic, even a one-day lapse can be detected by the system.

What counts as a coverage lapse?

A coverage lapse occurs when:

- An old policy is canceled before a new policy starts

- A policy expires without renewal

- A payment failure causes cancellation

- Incorrect cancellation dates are recorded

Coverage lapses are not measured by intent. They are measured by actual coverage dates.

Consequences of a coverage lapse in California

The consequences can extend far beyond a single missed day.

DMV Penalties

A lapse can result in:

- Vehicle registration suspension

- Reinstatement fees

- Proof-of-insurance requirements

Driving with suspended registration can lead to further fines.

Insurance pricing consequences

Insurers view lapses as risk indicators.

Potential effects include:

- Higher premiums

- Reduced discount eligibility

- Limited carrier options

- Requirement to pay premiums upfront

Avoiding a lapse protects long-term insurability.

The golden rule: Never cancel before the new policy is active

The most important rule when switching insurers is simple:

Never cancel your existing policy until the new policy is active.

What “active” means

A policy is active when:

- The effective date has begun

- Coverage is confirmed in writing

- A policy number has been issued

A quote or application is not coverage.

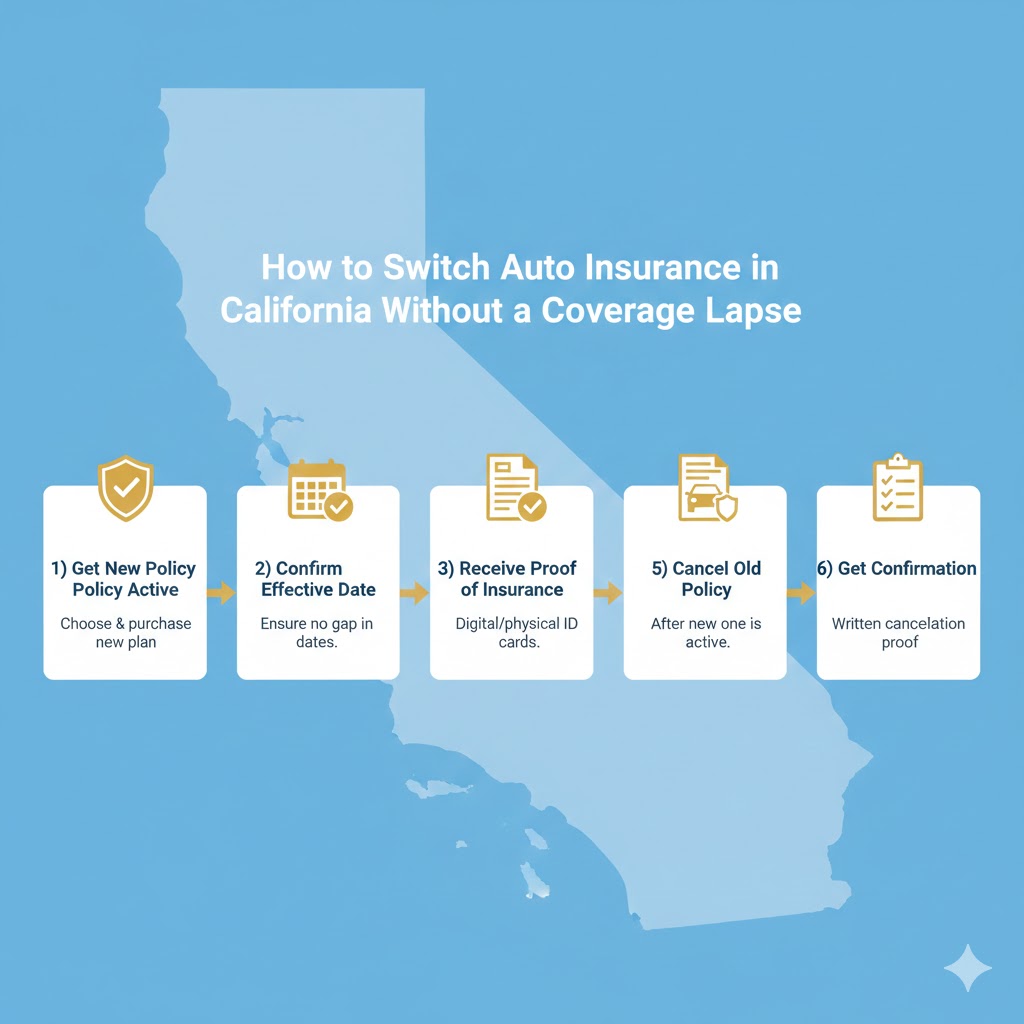

Step-by-step: Switching auto insurance without a lapse

Step 1: Secure the new policy first

When switching insurers:

- Choose the new carrier

- Confirm coverage limits and deductibles

- Set the effective date

The effective date should match or precede the old policy’s cancellation date.

Step 2: Align the effective dates carefully

Best practice:

- Start the new policy one day before or the same day as cancellation

- Avoid gaps between midnight and policy start times

Policies typically begin at 12:01 a.m. on the effective date unless stated otherwise.

Step 3: Obtain written proof of coverage

Before canceling the old policy:

- Download the declarations page

- Save the insurance ID card

- Confirm policy activation email

Documentation protects against reporting errors.

Step 4: Cancel the old policy correctly

Cancellation should be:

- Requested in writing or through official channels

- Dated after the new policy starts

- Confirmed with written acknowledgment

Never rely on verbal cancellation alone.

Step 5: Verify DMV reporting

California insurers report coverage electronically, but errors can occur.

Drivers should:

- Check DMV records online

- Confirm vehicle registration status

- Retain proof of coverage

This step is often overlooked but critical.

Switching at renewal vs. mid-policy

Switching at renewal

Pros:

- Clean transition

- No refunds required

- Lower risk of errors

This is the safest switching scenario.

Switching mid-policy

Mid-policy switching is legal but requires precision.

Risks include:

- Overlapping coverage confusion

- Refund delays

- Incorrect cancellation dates

Mid-policy switching should be handled carefully, especially when monthly billing is involved.

What about overlapping coverage?

Some drivers intentionally overlap coverage by one day.

Is overlap a problem?

No. Overlap is safer than a gap.

Potential downsides:

- Paying one extra day of premium

- Minor administrative inconvenience

Overlap eliminates lapse risk and is often recommended.

Switching auto insurance with monthly payments

Monthly billing increases lapse risk.

Common issues

- Automatic payments stop prematurely

- Final bills are missed

- Cancellation dates are misaligned

Drivers paying monthly should:

- Confirm final payment status

- Request written cancellation confirmation

- Monitor bank statements

Switching auto insurance with an open claim

California allows switching insurers with an active claim.

Key rules:

- The old insurer remains responsible for the claim

- The new insurer covers future incidents

- Claims history still follows the driver

Coverage must remain continuous throughout the process.

Switching after selling or replacing a vehicle

Vehicle changes often coincide with insurer switches.

Best practice:

- Ensure the new vehicle is insured before driving

- Avoid canceling coverage until registration updates are complete

- Confirm VIN accuracy

Registration and insurance must stay synchronized.

Common mistakes that cause coverage lapses

- Canceling early to save money

- Assuming a quote equals coverage

- Misunderstanding effective dates

- Ignoring DMV notifications

- Failing to confirm insurer reporting

Most lapses are preventable with proper sequencing.

How long a lapse affects your record

Even short lapses can remain visible to insurers for years.

Effects include:

- Higher initial quotes

- Fewer carrier options

- Increased scrutiny during underwriting

Avoiding a lapse protects future flexibility.

How agents vs. direct insurers handle switching

Agents

Pros:

- Date coordination assistance

- Cancellation guidance

- Error prevention

Cons:

- Limited carrier selection

Direct insurers

Pros:

- Fast online setup

- Immediate policy binding

Cons:

- Greater responsibility on the driver

Drivers should choose the method that minimizes error risk.

Switching auto insurance and proof of financial responsibility

California treats insurance as proof of financial responsibility.

A lapse may require:

- SR-22 filing in some cases

- Additional DMV documentation

- Registration reinstatement procedures

These complications are easily avoided with proper timing.

Switching auto insurance in California does not have to involve risk. Coverage lapses occur not because switching is dangerous, but because the process is handled incorrectly. By securing new coverage first, aligning effective dates, canceling properly, and verifying DMV reporting, drivers can switch insurers smoothly and legally.

In California’s tightly regulated insurance system, continuous coverage is essential. Drivers who follow the correct switching sequence protect their registration, preserve discount eligibility, and avoid unnecessary premium increases. When done right, switching auto insurance is not only safe it is one of the smartest financial moves a California driver can make.