Low mileage car insurance discounts in California: how drivers qualify, verify mileage, and maximize savings

Among all car insurance pricing factors, annual mileage is one of the most influential and one of the most misunderstood. In California, mileage plays an especially important role because state law restricts insurers from using many traditional rating variables such as credit score, income, and demographic profiling. As a result, how much and how often a driver uses their vehicle has a direct and measurable impact on insurance premiums.

The Low Mileage Car Insurance Discount is one of the most accessible savings opportunities available to California drivers. Remote work, hybrid schedules, urban living, and alternative transportation have dramatically reduced annual mileage for millions of residents, yet many continue to pay premiums based on outdated or inflated mileage estimates.

This article provides a complete, practical, and legally grounded explanation of how low mileage insurance discounts work in California, who qualifies, how mileage is verified, common mistakes that cost drivers money, and how to strategically use mileage reductions to achieve long-term insurance savings.

Why mileage matters more in California than in other states

California’s insurance pricing framework places mileage near the top of its risk assessment hierarchy.

Legal context

Under Proposition 103, insurers must prioritize:

- Driving safety record

- Annual mileage

- Years of driving experience

At the same time, insurers are restricted or prohibited from using:

- Credit history

- Gender

- Income level

- Education

- Certain ZIP-code pricing practices

Because of these restrictions, mileage becomes a primary proxy for risk exposure. Simply put, fewer miles driven equals fewer opportunities for accidents, claims, and losses.

What is a low mileage insurance discount?

A low mileage insurance discount is a premium reduction granted to drivers who operate their vehicles less than the average annual mileage. In California, this discount is not a single standardized percentage but rather a pricing adjustment applied through mileage tiers.

Instead of asking whether a driver “has” the discount, the correct question is:

“How does my annual mileage affect my base premium?”

Drivers who fall into lower mileage tiers benefit from significantly reduced rates compared to high-mileage drivers, even when all other factors are equal.

Average mileage in California

Understanding average mileage provides context for qualification.

Typical annual mileage benchmarks

- National average: approximately 13,000–14,000 miles per year

- California average: often lower in dense urban areas, higher in suburban and rural regions

Many California drivers fall well below the national average due to:

- Traffic congestion discouraging unnecessary trips

- Strong public transportation systems in major cities

- Increased remote and hybrid work arrangements

Drivers below 10,000 miles per year often qualify for meaningful premium reductions.

Mileage tiers used by insurers

While exact thresholds vary by insurer, most California companies use similar mileage bands.

Common mileage categories

- Under 7,500 miles per year

Maximum low mileage pricing advantage - 7,500 to 10,000 miles per year

Moderate discount tier - 10,000 to 12,000 miles per year

Baseline or neutral pricing - Over 12,000 miles per year

Higher risk exposure pricing

Small differences in reported mileage can move a driver between tiers, resulting in noticeable premium changes.

Who qualifies for low mileage discounts in California?

Many drivers qualify without realizing it.

High-probability groups

- Remote and hybrid workers

- Retirees

- Urban residents using public transportation

- Students attending school locally

- Households with multiple vehicles

- Drivers who primarily use vehicles for errands rather than commuting

Even a reduction of 2,000–3,000 miles per year can move a driver into a lower pricing tier.

How insurers verify mileage

Mileage verification is a critical part of eligibility. Insurers rely on multiple methods to confirm reported mileage.

Common verification methods

- Self-Reported Estimates

Used at policy inception or renewal

Subject to verification - Odometer Readings

Requested during underwriting or claims

Often required during policy reviews - Vehicle Inspections

In-person or photo-based inspections

Used to confirm vehicle condition and mileage - Service and Maintenance Records

Oil change and service logs can reveal usage patterns - Telematics or Usage-Based Programs

Optional participation may provide precise mileage data

Providing accurate information is essential. Misrepresentation can result in policy adjustments or denied claims.

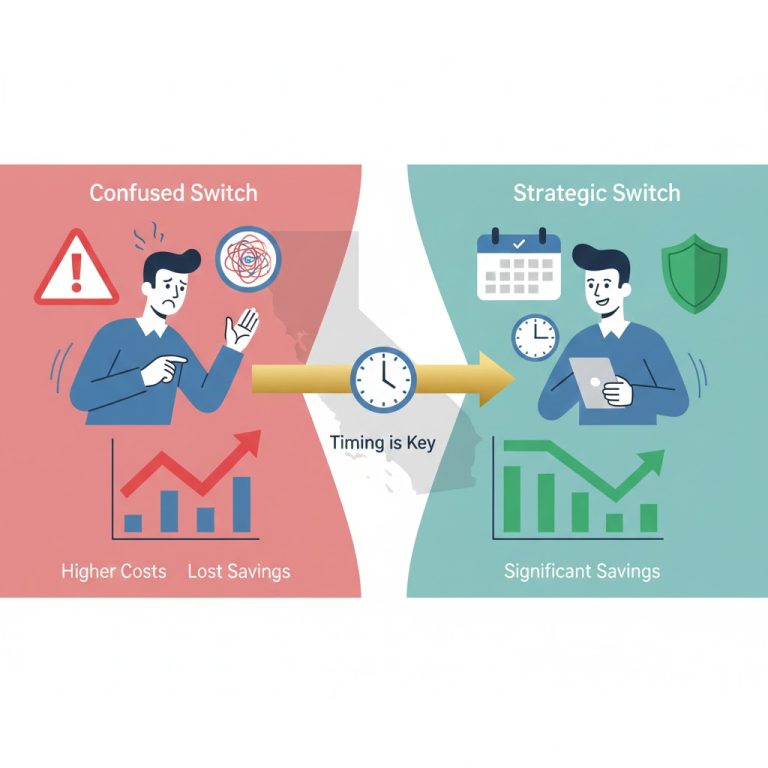

Common mistakes drivers make with mileage

Many drivers unintentionally overpay due to simple errors.

Overestimating mileage

Drivers often estimate mileage conservatively, assuming:

- Overreporting is safer than underreporting

- Insurers will adjust automatically

In reality, insurers rarely reduce premiums unless prompted.

Failing to update mileage after life changes

Common life events that reduce mileage include:

- Switching to remote work

- Retirement

- Relocation closer to work

- Adding another vehicle to the household

Failure to update mileage after these changes leads to inflated premiums.

Assuming mileage is reviewed automatically

Most insurers do not proactively reassess mileage unless:

- A claim occurs

- A policyholder requests a review

- Verification is triggered by underwriting audits

How to request a mileage reassessment

Drivers can and should request mileage reviews.

Best time to request

- At policy renewal

- After major lifestyle changes

- After a year of consistently reduced driving

How to prepare

- Record odometer readings

- Gather maintenance records

- Estimate projected mileage for the next policy period

A written request creates documentation and reduces the risk of miscommunication.

Low mileage discount vs. usage-based insurance

Low mileage pricing and telematics programs are often confused.

Key differences

Low mileage discount:

- Based on total annual miles

- No behavior tracking

- Simple verification

Usage-based insurance:

- Tracks driving habits

- Monitors time of day, braking, speed

- Requires app or device

Drivers can qualify for both, but low mileage pricing stands alone as a foundational cost reducer.

How low mileage affects claims risk

Insurance pricing is rooted in actuarial data.

Statistical relationship

Lower mileage correlates with:

- Fewer accident opportunities

- Reduced exposure to high-risk conditions

- Lower frequency of claims

This relationship holds true regardless of vehicle type, age, or location.

Low mileage and urban driving

Urban drivers often assume city driving negates mileage benefits due to congestion.

In reality:

- Stop-and-go traffic increases trip time, not mileage

- Shorter distances still reduce exposure

- Urban drivers often qualify for low mileage tiers

Urban living is one of the strongest predictors of low annual mileage.

Low mileage and multi-vehicle households

Households with multiple vehicles frequently underestimate the impact on insurance costs.

Strategic allocation

- Assign primary commuting mileage to one vehicle

- Designate secondary vehicles as low-mileage

- Adjust coverage accordingly

Each vehicle is rated individually, allowing households to optimize premiums strategically.

How much can drivers save?

Savings depend on:

- Starting premium

- Mileage tier change

- Vehicle and coverage levels

Example scenarios

- Dropping from 12,000 to 8,000 miles/year may reduce premiums by 10–15 percent

- Dropping below 7,500 miles/year may produce even greater savings

Over multiple policy years, savings can reach thousands of dollars.

Low mileage and claim history

Mileage discounts do not protect against rate increases from claims.

However:

- Low mileage drivers statistically file fewer claims

- Reduced exposure lowers long-term premium volatility

Mileage reductions indirectly contribute to better pricing stability.

Misconceptions about low mileage discounts

Myth 1: Only seniors qualify

False. Any low-usage driver qualifies.

Myth 2: City driving cancels the discount

False. Mileage, not traffic density, is the primary factor.

Myth 3: Insurers automatically adjust mileage

False. Drivers must request reassessments.

Myth 4: Underreporting mileage is harmless

False. Misrepresentation can void coverage.

Best practices for maintaining low mileage status

- Track odometer readings monthly

- Reassess mileage annually

- Avoid unnecessary overestimation

- Notify insurers of lifestyle changes

- Keep maintenance records

Low mileage car insurance discounts in California represent one of the most reliable and underutilized ways for drivers to reduce premiums. As work habits, transportation options, and lifestyles evolve, mileage reductions are becoming increasingly common but only drivers who actively update and verify their usage benefit financially.

By understanding mileage tiers, verification methods, and reassessment strategies, California drivers can transform reduced driving into meaningful, long-term insurance savings. For those committed to controlling costs without sacrificing coverage, low mileage pricing is not optional it is essential.